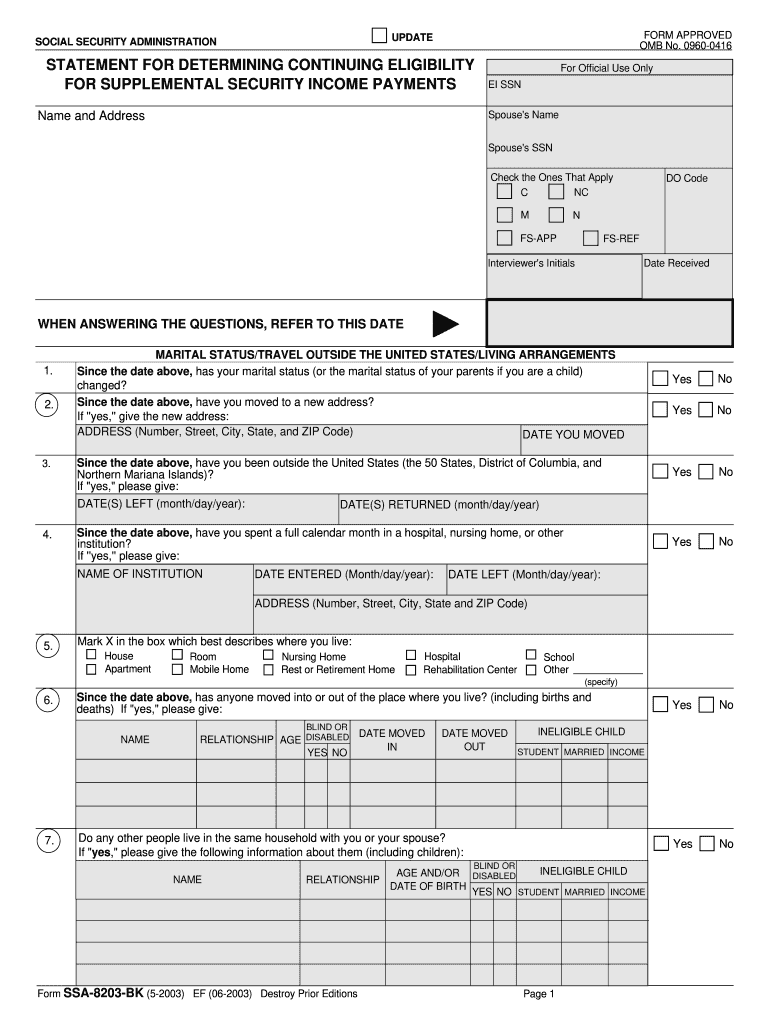

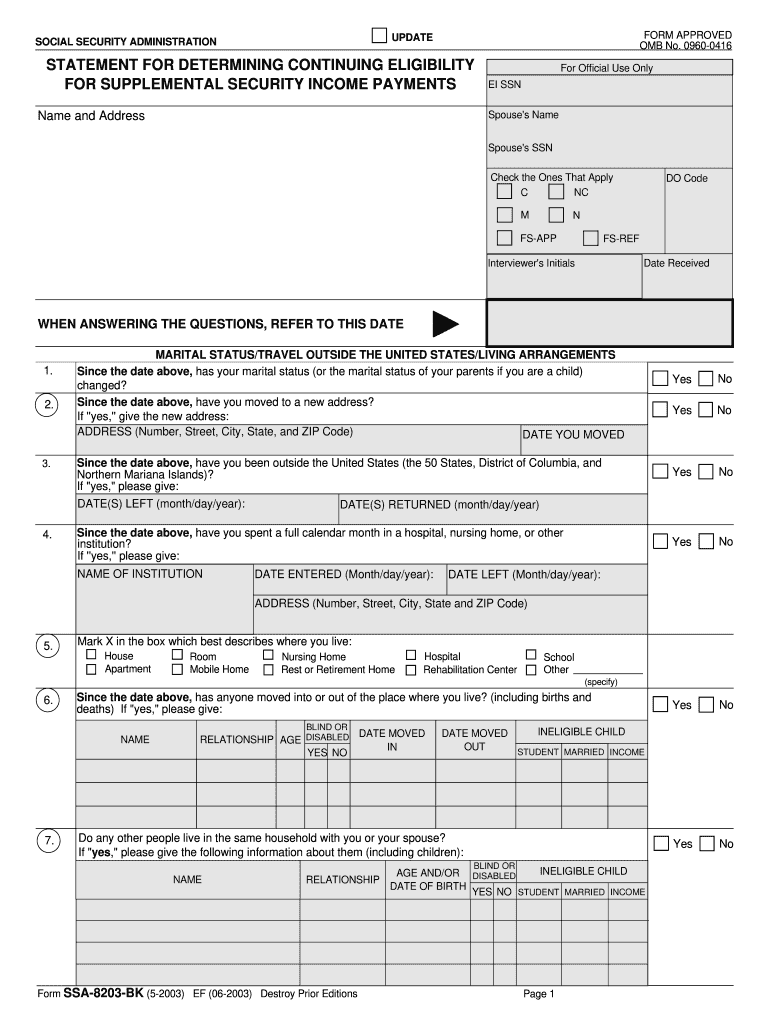

SSA-8203-BK 2003-2024 free printable template

Get, Create, Make and Sign

How to edit ssa 8203 online

How to fill out ssa 8203 form

How to fill out ssa 8203:

Who needs ssa 8203:

Video instructions and help with filling out and completing ssa 8203

Instructions and Help about 8203 form

We've had lots of egregious cases the man in the wheelchair claimed a serious disability says Workers Compensation Fund Special Investigations VP Joel camp that he was coming out of the doctor's appointment in the chair, and then he wheels it up the sidewalk of ways and when he thinks he's out of sight of people that would care he gets out of the chair and pushes it, and it's told the insurance adjuster and also the medical doctors that he can't walk WCF the largest workplace insurer in Utah says the man taking off the brace claimed he hurt his hand on the job but that a doctor could find no injury, and so he had been referred to a subsequent physician to do it another exam to make sure we weren't missing something from the back of his vehicle the man grabbed a sledgehammer and looked about, and he decided before he went into the medical appointment to Henry's hand with that mallet to at least make his hand look like it was injured in some manner or infected or whatever that was right before another medical appointment all right he was he left that that truck and walked to the doctor's office the doctor it said stopped prescription narcotics for the man after seeing as pretty pathetic in dozens of cases a year the Workers Compensation Fund says it discovers flagrant fraud which is turned over to prosecutors sometimes there are criminal charges, and we're told plea bargains and orders paying back money but not many defendants sentenced to do time yes there are people who commit fraud I know there are people who commit fraud I believe it firmly it angers me, but sometimes it's not black and white either this man was charged with workers compensation insurance fraud and found not guilty I was hurt I was injured I wasn't lying I wasn't trying to get anything special I was just trying to get treated that's it after what he says was a serious back injury surveillance showed him repairing his car he says he was in pain but had little money, so he had no choice and working a little at a time replacing a water pump took days to finish he says the photos do not tell his whole story we're not identifying you, but I'm looking at you, he looked pretty good to me hmm I agree I tried to go back to work one day I could feel okay but the next day yeah I'd be in agony the Workers Compensation Fund says an acquittal is rare and that people in these video clips entered guilty pleas workers compensation is a private insurer that began as a state agency on the federal level the Social Security Administration which has an office in this building in downtown Salt Lake provides disability benefits it also is a partner in a so-called cooperative disability investigations unit operating in Salt Lake for roughly a year which tries to stop fraud before it starts in a recent three-month period the local CDI unit as it's called says it confirmed 42 cases of fraud or similar fault it says a 25-year-old man cited a raft of bad health in seeking disability benefits right atrial...

Fill information settlement : Try Risk Free

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ssa 8203 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.